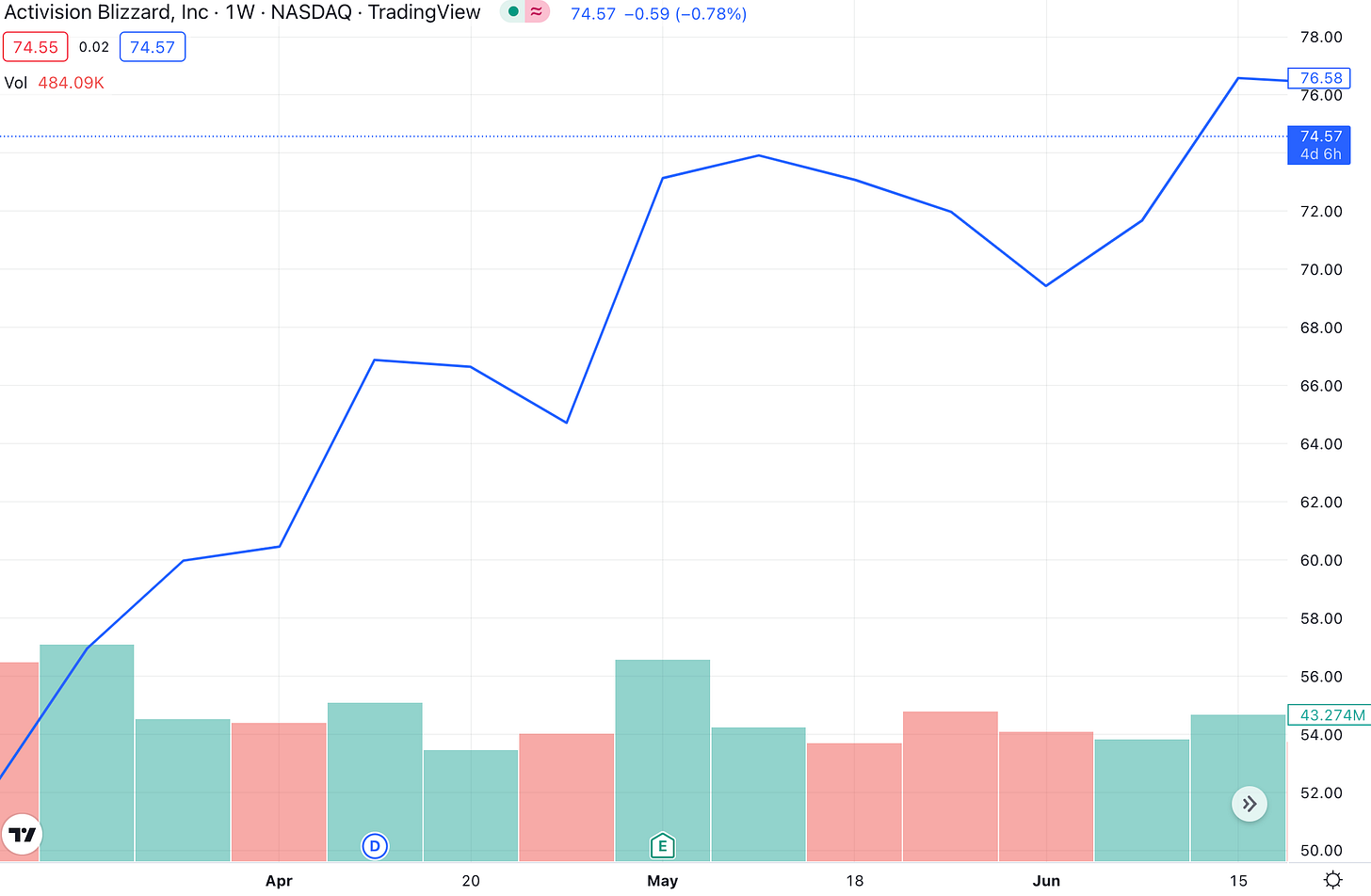

On January 18, 2022, MSFT announced its intent to acquire ATVI for $68.7 billion ($95 per share.) Under the terms of the agreement, which would be expected to close by Spring 2023, MSFT would acquire Activision Blizzard and its subsidiaries, including Activision, Blizzard Entertainment, and King. This would give MSFT ownership of gaming franchises like Call of Duty, Overwatch, Candy Crush, and World of Warcraft, among others.

Since the deal was announced ATVI had risen approximately 15.8% as of December 9th. If the acquisition reaches completion, it will be the largest video game acquisition in history. MSFT would become the world’s third-largest gaming company, behind only TCEHY and SONY. ATVI and its assets will become a sibling entity to Xbox Game Studios under a new Microsoft Gaming Division and MSFT will be able to offer ATVI games on their Xbox game pass service.

However, on December 9th the FTC announced its intention to block MSFT’s deal, citing monopoly claims. If you are interested in reading the complaint the link will be here: FTC link. However, if you would prefer not to read the 23-page complaint I will give a brief summary:

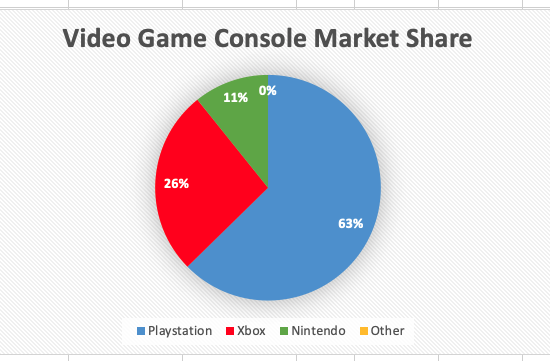

-MSFT and SONY control the market for gaming consoles

-The number of independent gaming companies is minimal

-MSFT's acquisition of ATVI would significantly decrease competition in the gaming market

The Proposed Acquisition is reasonably likely to substantially lessen competition or tend to create a monopoly in the Relevant Markets by creating a combined firm with the ability and increased incentive to withhold Activision’s valuable gaming content from, or degrade Activision’s content for, Microsoft’s rivals. The combined firm would have the ability to exclude Microsoft’s rivals from access to some or all of Activision’s content in the Relevant Markets. Microsoft would have the power to decide if, when, and to what extent Activision content will be available on competing products. The Proposed Acquisition is likely to increase entry barriers, thereby dampening beneficial rivalry and innovation. If permitted to make Activision a captive supplier, Microsoft would have a substantially increased incentive to engage in strategies to that would likely lead to reduced consumer choice, higher prices or lower quality products, and less innovation.

-FTC cited MSFT's acquisition of Bethesda Studios in 2021.

In March 2021, Microsoft acquired ZeniMax Media Inc. (“ZeniMax”), the parent company of the well-known game developer and publisher Bethesda Softworks LLC (“Bethesda”). Microsoft assured the European Commission (“EC”) during its antitrust review of the ZeniMax purchase that Microsoft would not have the incentive to withhold ZeniMax titles from rival consoles. But, shortly after the EC cleared the transaction, Microsoft made public its decision to make several of the newly acquired ZeniMax titles, including Starfield, Redfall, and Elder Scrolls VI, Microsoft exclusives.

-ATVI is an extremely important gaming company on the market with elite status as a AAA publisher, and access to AAA publishers is extremely important to competition within the gaming market

The gaming industry recognizes a limited top tier of independent game publishers, sometimes referred to as the “Big 4” or simply the AAA publishers: Activision, Electronic Arts, Take-Two, and Ubisoft. These publishers reliably produce AAA games for high-performance consoles and collectively own a significant portion of the most valuable IP in the gaming industry. These high-profile franchises include, for example, Call of Duty (Activision), FIFA (EA), Grand Theft Auto (Take-Two), and Assassin’s Creed (Ubisoft).

-MSFT and SONY are the only significant competitors in the gaming console market.

Other consoles lack the high performance of the Xbox Series X|S and PS5 consoles. For example, the Nintendo Switch, which is designed to allow portable, handheld use, necessarily sacrifices computing power, which leaves it unable to play certain games that require more advanced graphic processing. Retailing at $299.99, the Nintendo Switch is also less expensive than the Xbox Series X and PlayStation 5 consoles, both priced at $499.99. While the Xbox Series S had the same retail price at launch as the Nintendo Switch, the graphical and processing capabilities of the Series S are much more aligned with the Xbox Series X and PS5 consoles. The Xbox Series S enables gamers to play the same video games as the Xbox Series X, both of which offer more graphically advanced gameplay than on the Nintendo Switch.

-The only High-Performance Consoles on the market currently are the newest gen. Xbox and Playstation consoles.

The only High-Performance Consoles offered for sale today are the most recent generation of Microsoft Xbox and Sony PlayStation consoles—the Xbox Series X|S and the PS5. The Xbox Series X|S and PS5 are therefore included within the Relevant Market.

-MSFT's acquisition of ATVI is unlawful on grounds of violating anti-competition laws.

122. The allegations above in paragraphs 1 to 121 are incorporated by reference as though fully set forth.

123. The Proposed Acquisition, if consummated, may lessen competition substantially or tend to create a monopoly in interstate trade and commerce in the Relevant Markets throughout the country, including as a result of the combined firm’s ability and incentive to withhold or degrade content from downstream rivals in the Relevant Markets

124. The Proposed Acquisition violates Section 7 of the Clayton Act, as amended, 15 U.S.C. § 18 and is an unfair method of competition that violates Section 5 of the FTC Act, as amended, 15 U.S.C. § 45.

Why the FTC’s reasoning is wrong

After reading through the entire complaint I found four major flaws within the FTC’S reasoning.

1. MSFT made no promises to the EU

One of the FTC’s major arguments for the anti-competition violation is the idea that if MSFT purchases ATVI, ATVI titles will be made into Xbox-exclusive games. To support this the FTC claimed that when MSFT bought out Bethesda studios back in 2021, MSFT promised the EU commission that Bethesda games would not become exclusives. Shortly afterward, Bethesda games supposedly became Xbox exclusives. The FTC is using as “proof” that despite MSFT saying that there are no plans for ATVI games to become Xbox exclusives, they still will. One problem with that. MSFT never told the EU commission that Bethesda games would be kept unexclusive. In fact, an official statement by the EU commission directly refutes this statement, stating the EU commission, “cleared the Microsoft/ZeniMax transaction unconditionally.”

2. MSFT and SONY are not the only competitors

Another major argument the FTC put forth was the idea that when it comes to consoles, the PS5 and Xbox Series X|S are the only ones worth taking seriously. The people writing this motion have most likely never touched newer gaming consoles and their only information was probably just the spec sheets. Because yes, if you just look at the specs SONY and MSFT flagships are currently the only high-performance consoles on the market. The closest competitor, Nintendo, is significantly behind. While this is technically true, Nintendo isn’t really being fairly represented here. First, both MSFT and SONY released their current flagships in 2020, while the Nintendo Switch was released in 2017. Additionally, the Nintendo Switch shouldn't even be able to compete with either the PS5 or Xbox Series X|S in terms of operating power. Unlike either flagship, the Nintendo was built to both function as a mobile device and console.

Because the Nintendo Switch is designed to operate both with and without a screen to display on, it is significantly less powerful than its competitors. However, Nintendo has actually created a fantastic niche for itself within the console market, with many Playstation and Xbox owners also owning a Nintendo Switch. If Nintendo were to release a console built without mobile capabilities and with today’s technology, it would almost certainly meet or exceed both MSFT’s and SONY’s current flagships.

3. Sony is already well known for exclusives

If MSFT does go back on its word and did make ATVI titles exclusive to the Xbox, it wouldn’t lead to a monopoly. Part of the reason that Playstation is so incredibly popular stems from releasing high-budget, high-quality games to accompany their consoles. For example one of the most popular games of 2022 is God of War Ragnorkok a PS5 exclusive game. Exclusive games do improve a console’s popularity, but as long as both major companies release exclusives people will still purchase from both companies.

In my opinion, the FTC has little to no evidence that can actually block the acquisition. The most likely reason for the FTC going after MSFT is the United States government’s distrust of Big Tech. However, simply disliking MSFT is not grounds to block the acquisition.

Short-term possibility

Even if you think the FTC will manage to block MSFT the acquisition, ATVI still has a bullish outlook in the short term. In Q4 of 2022, ATVI released two new games in the Call of Duty franchise. On November 16th ATVI released the much-anticipated Call of Duty Warzone II, the sequel to Call of Duty Warzone, the wildly popular battle royale released in 2020.

Because both Warzone I and II are free-to-play games, it is significantly more difficult to judge how successful the game is going to turn out to be. However, some rough estimations can be made based on information ATVI has currently released. Warzone I took 10 days after release to reach 30 million players, while Warzone II reached 25 million in only 5 days. While this doesn’t directly translate to sales, it should be noted that Warzone I has made around $1 billion, and Warzone II is currently expected to beat that.

ATVI has also released another game recently, that being Call of Duty: Modern Warfare II. Despite only being released on October 27, Modern Warefare II has quickly become the most popular game of the year with over $1 billion in revenue in the first 10 days alone. Because of the recent releases, the Q4 earnings consensus is expected to be 3x the earnings of Q3, at $1.50 compared to $0.50. If going off of historical context, title releases from ATVI will often positively the stock.

Overall I’m bullish on ATVI. It offers both good short-term and longer-term returns. At the moment I would recommend investing in ATVI now and reassessing after the Q4 earnings reports come out. Since the MSFT buyout is still very much in the air, waiting until the Q4 earnings come out in early February gives time for more information to come out about the acquisition. This strategy also provides security given that if at the reassessment you determine that the acquisition might go through, you can sell off ATVI, likely for a profit.

Excellent write-up by another in a long-line of DeMuth superstars.