How the invasion of Ukraine swept the markets

Unless you have been living under a rock for the past month you are probably aware of the Russian invasion of Ukraine. On February 24, 2022 Russian soldiers crossed into Ukrainian borders, the first time Russia had done so since the annexation of Crimea since 2014. In a response to the attack, nations from around the world introducing sanctions onto Russia. The Russian economy was devastated and the value of the Russian ruble fell 60%, to a low of 0.0072 USD on March 7, 2022. For context, in the online game Roblox it has an online currency. Named Robux, it can be used to purchase in-game items, items that have no real world value. The approximated value of a single Robux is 0.0125 USD.

The Crash

Perhaps one of the biggest punishments given to Russia was doled out by the United States, calling for a complete embargo of Russian oil, natural gas, and coal. This will prevent billions of dollars going to Russia, and devastated the Russian energy giants. With newfound embargoes and international pressure, Russian energy giant Gazprom, fell drastically, with stocks losing 33% of its antebellum value.

Just because Russian energy has stopped arriving on American shores does not mean the demand has subsided. 700,000 barrels of crude oil and petroleum where imported from Russia last year- per day, and billions in revenue on the table.

Power Vacuum

Since the day of the invasion of Ukraine, American energy company Chevron (CVX) stock price has risen approximately 22% since February 24, 2022 as of March 21, 2022.

Reaching its highest share price in the companies history, the next reported earnings is likely to re-instill confidence in investors following the battering the company took during Covid-19. Another reason to consider this as a potential investment is because it belongs to the Dividend Aristocrats, having increased dividends for more than 25 straight years. This, paired with announcements of ventures in renewable energy with Bunge, foresees a bright future for the company, and its investors.

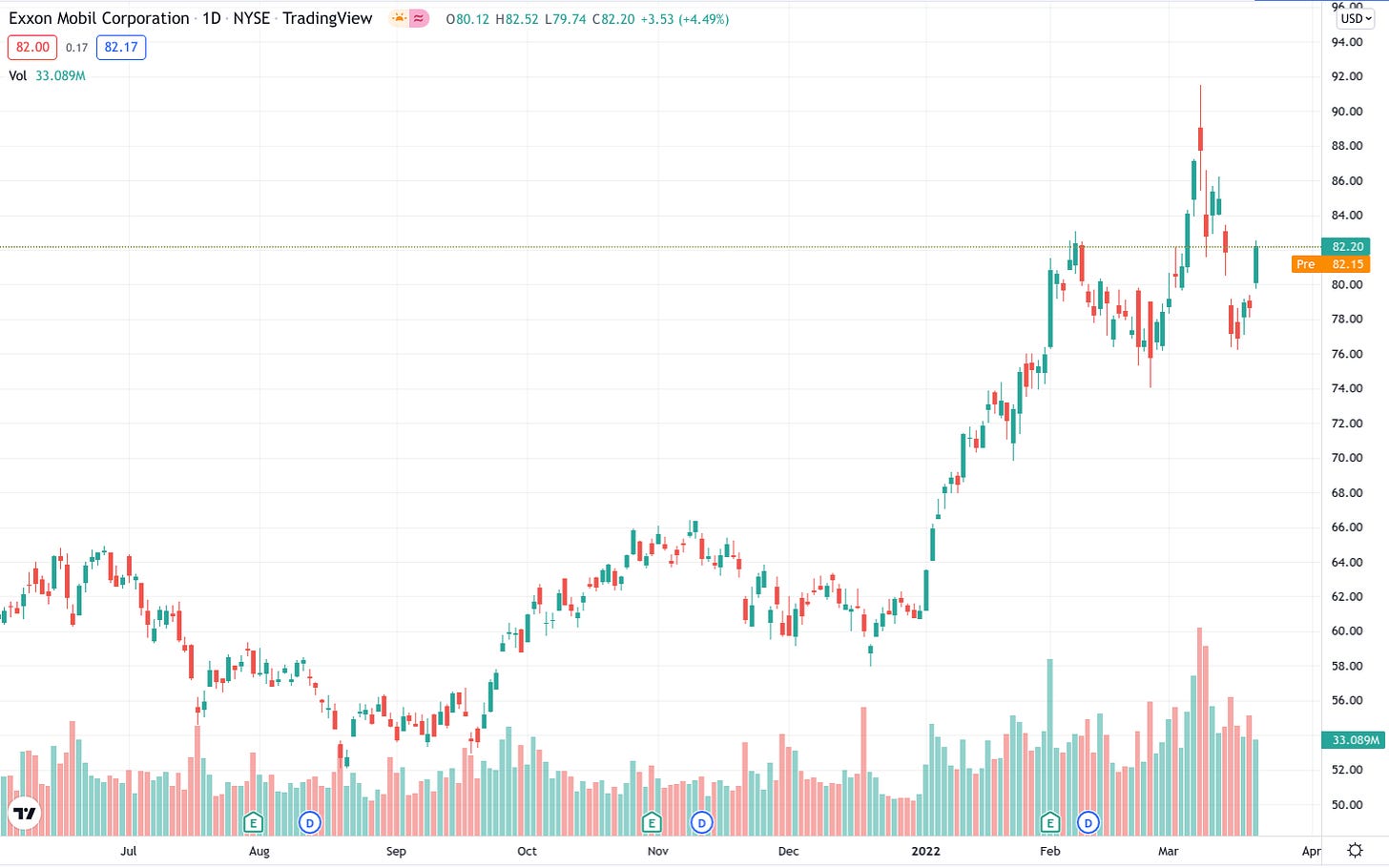

Another stock to keep a sharp eye on amid the economic and political chaos following the Russian invasion into Ukraine is Exxon Mobil (XOM), another American energy giant who has also benefited from the invasion of Ukraine. Although Exxon has not risen nearly has much compared to Chevron, the stock rose, peaking on March 8th at approximately 15.8% growth. Exxon also offers a 4.28% quarterly dividend, and has increased it for 39 consecutive years.`

Although the invasion of Ukraine threw the world into turmoil, that does not mean it cannot be taken advantage of.

Like what you’ve read? Subscribe to our blog by adding your email address to the form below, and be the first to know when a new article is posted!