High-Yield Dividend Hunting? - A case for EPR Properties

EPR Properties is a real estate investment trust that focuses on properties that can be used for entertainment, education, and recreation. EPR owns properties in the US and Canada, with the company leasing its properties in a triple net structure. This means that the tenant is responsible for all the maintenance, upkeep, and other costs associated with owning the property. EPR properties holds a 3.9 billion USD market cap and generated $530 million USD in annual revenue (2021). Since the business model holds tenants accountable financially for upkeep and the company only has 53 employees, they have a low marginal cost.

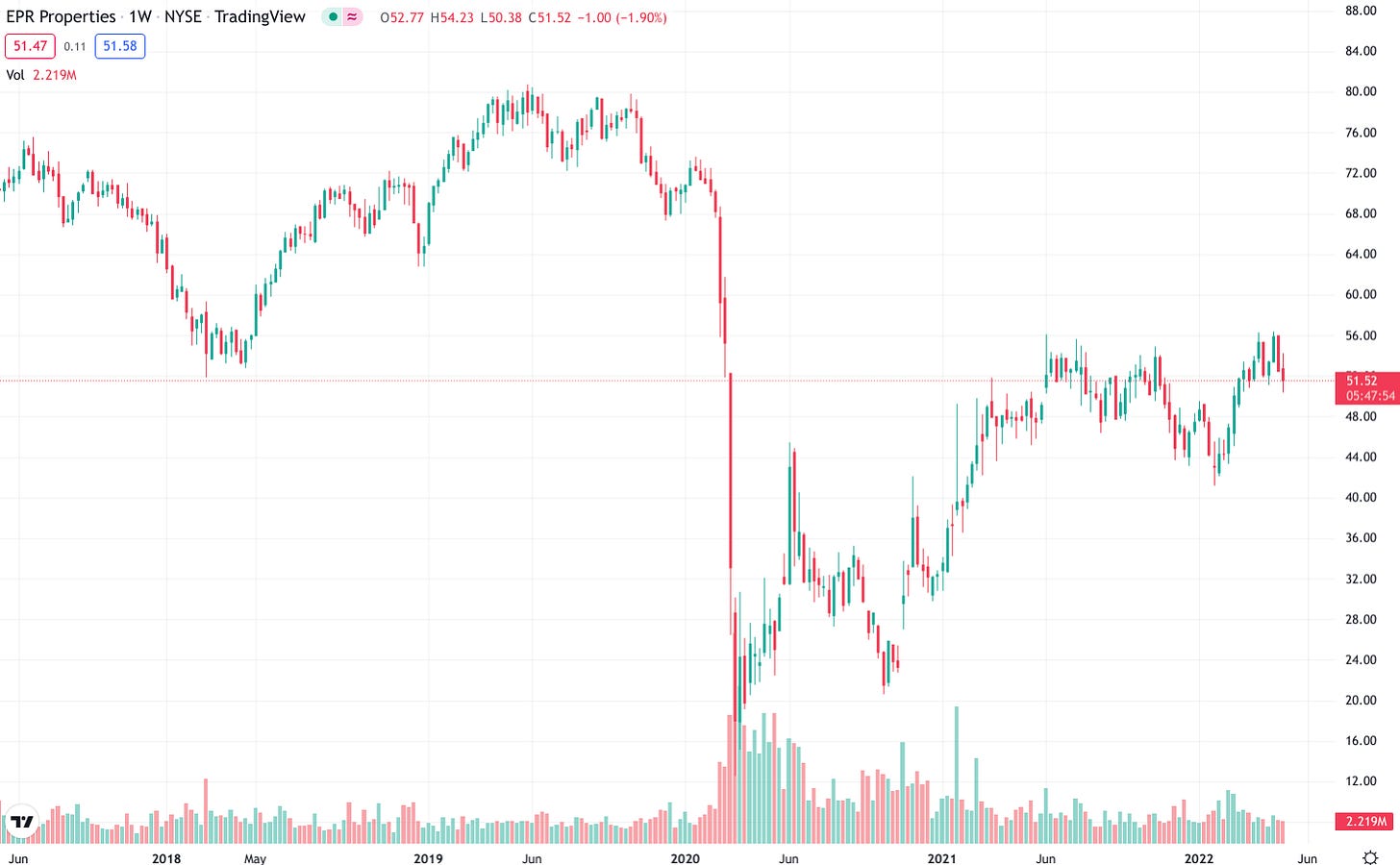

With COVID-19 and the resulting economic downturn the company heavily suffered, but has had substantial recovery, although not having met the pre-covid level. 2020 caused the company’s revenue to drop 40%, but revenue grew 29% in 2021. Additionally, 97% of their properties were able to cover rent in the fourth quarter of 2021, which grants the company to stability needed to focus on expanding back to their previous size.

Source: TradingView

In the pre-pandemic world, they were steadily increasing their yearly net income until a high in 2018 of $243 million USD, when the pandemic hit. The pandemic put a temporary end to EPR’s decade long dividend growth streak, but since then the dividend as been brought back. Additionally, because of the business model prioritizing stability the dividend payouts will remain stable. Currently the dividend yield stands at 6.28%, easily surpassing the market median of 2.65%.

Historically, the only major crashes in the EPR stock have occurred during periods where the housing market crashed, with the most significant crash other than the 2020 crash occurring in 2009.

With the housing market predicted to continue to rise in 2022, the company will continue to profit off of tenants, but also from the property itself. Just like we, the stockholders can profit off of an increase in stock value or a dividend, in this scenario the property is the stock and the tenants' are the dividend. If the housing market goes down this year, then it is an opportunity for expansion of EPR, so the company still benefits.

EPR Properties is set up to achieve slower but much more stable growth by minimizing the risk on the company, albeit at the cost of potentially higher profits by not holding tenants accountable for all expenses. The company also offers a high dividend that will continually earn money for investors while they hold stock in EPR. Because of this, EPR Properties would be best situated for a medium to long term hold.

Like what you’ve read? Subscribe to our blog by adding your email address to the form above, and be the first to know when a new article is posted!