Diversifying your assets, Masterworks

With inflation at a 40-year high and the markets recovering from a global pandemic, now more than ever is a great time to diversify your assets to create a more balanced portfolio.

Masterworks

The idea behind stocks is that a great way to invest money is to buy a company, but only a select few people actually have enough capital to purchase entire corporations. To fix this, the idea of stocks was invented. Instead of buying out whole companies, you just buy a little piece for a reduced price. This allowed practically everyone to start investing, because you can start with only a couple dollars.

That is the idea Scott Lynn had when he founded Masterworks. Through Masterworks you have the opportunity to invest in prices of artwork changing the amount of capital needed to start investing in art from millions to as little as twenty dollars.

Despite Masterworks being presented as an alternative asset class to stocks, there are several key differences that you have to take into account. The largest difference and by far the most important is that no one company owns the stock market, but in the case of Masterwork the whole system is run under a single group of people. This isn’t necessarily a bad or good thing, but you need to consider what changes it introduces.

Pros:

-Because Masterworks holds complete control over the system, every piece of art and artists used are vetted, so any piece you buy into is guaranteed to be authentic

-All artwork invested in is safely secured and stored by Masterworks, removing the typical issue of having to maintain any pieces you purchase

-Investing can start with as little as $20

-Possibility for high returns

-Do not need to be an accredited investor to open an account

Cons:

-There are no regulations on investing in art, so it is a high risk involved

-Compared to other investment options there are relatively high fees involved in art investments

-Possibility of not being able to access funds for extended periods of times

-You need to apply for an account which includes a phone interview

Because of the high fees involved in investing with Masterworks, a good rule of thumb is that anything less than 20% annual returns it will not be worth it.

Keep in mind that all fees will not be paid until the liquidation event when the artwork is sold. To date, Masterworks annual ROI has come out to an average of 29%, which is still a good deal compared to market average even with all of the fees factored in. One of the biggest benefits you get for the fees aside from the storage and sale of the artwork is in customer support. Upon getting a Masterworks account you are assigned a customer support representative who will always be the one you contact if you need help. Because all the customer support reps have a group of customers they work with, it mean they can be much more useful because they will have a greater understanding of you goals and how to best fit them.

Secondary Market

When you invest in an art piece on Masterworks, there are two ways to get those funds back. Masterworks will purchase pieces made from a variety of artists, like Banksy or Andrew Warhol. They will then typically hold that for a period of time, normally around 10 years, and then sell said piece. If you have invested in the piece you will then receive a proportionate amount of the money depending on how much you put it.

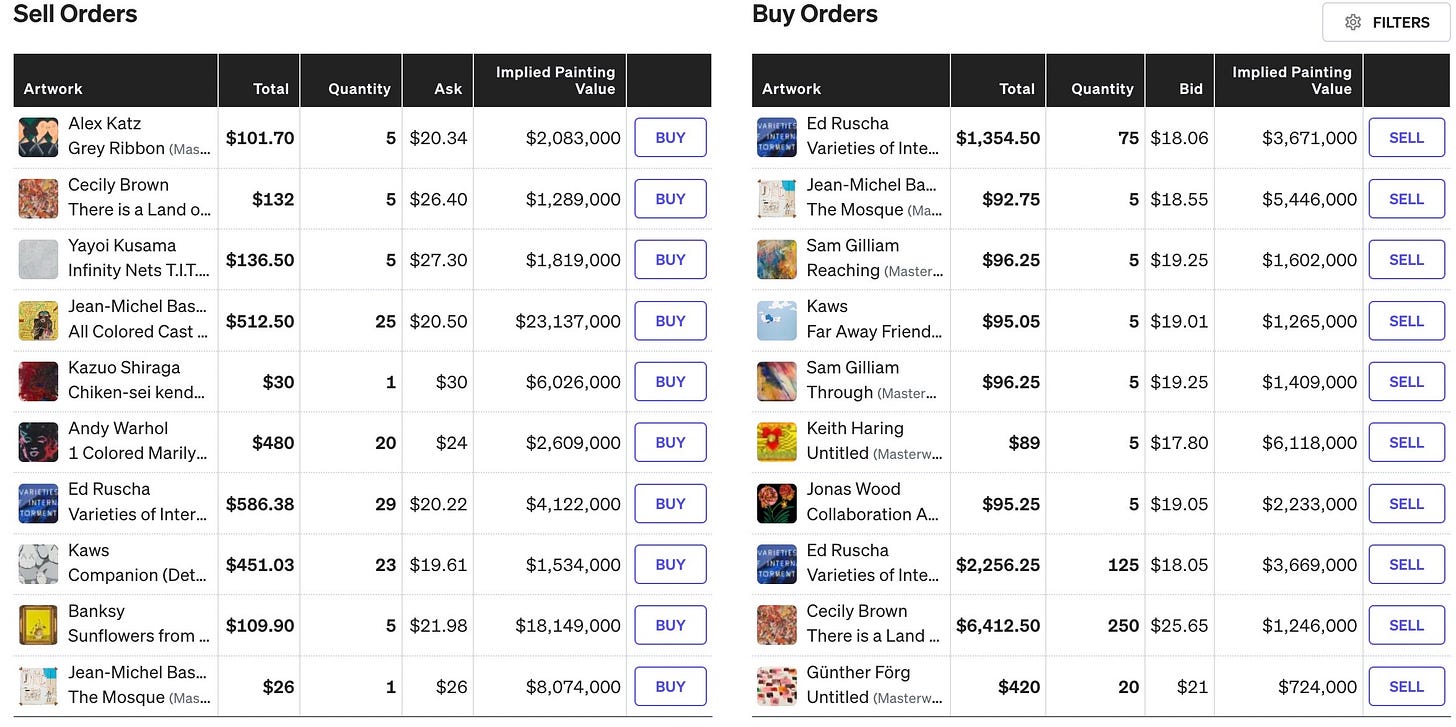

Alternatively you can use Masterworks secondary market, where you can buy or sell shares of artwork before Masterworks sells the piece. One of the most important things to keep in mind is that because these pieces do not trade in a high volume, the most recently listed price might not accurately represent what the current price is.

One of the greatest advantages for investing in art as opposed to stock is because it is a great hedge against inflation, but also market volatility.

This makes it a great option if you are looking to continue to see high ROI when going through a market recession, like we are now. To summarize, if you are looking for an alternative investment outside of stocks, Masterworks is worth considering because it allows you to invest in art without all the hassle of selling and storing the pieces, possibility of high returns, and a good counter to market volatility and inflation.